puerto rico tax incentive program

5 Best Tax Relief Programs of 2022. And within the first two years of living there you now need to buy a home in Puerto.

Open A Corporate Account In Puerto Rico Remotely Internationalwealth Info

The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities.

. Find Travel Content Updated Daily For Puerto rico tax incentives. Make Puerto Rico Your New Home. Puerto Rico requires to invest in competitive activities of high economic value and positive performance.

100 tax exemption from Puerto Rico income taxes on all short and long-term capital gains accrued after the individual investor becomes a bona-fide resident of Puerto Rico. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Puerto Rico has created an aggressive tax incentive program to connect with the global economy to establish an ever-growing array of service industries and to establish as an.

In the past few foreign investors have found the EB-5 Classification attractive due to the tax consequences on the investors worldwide income upon moving to the United States. Relief up to 96. Many high-net worth Taxpayers are understandably upset about the massive US.

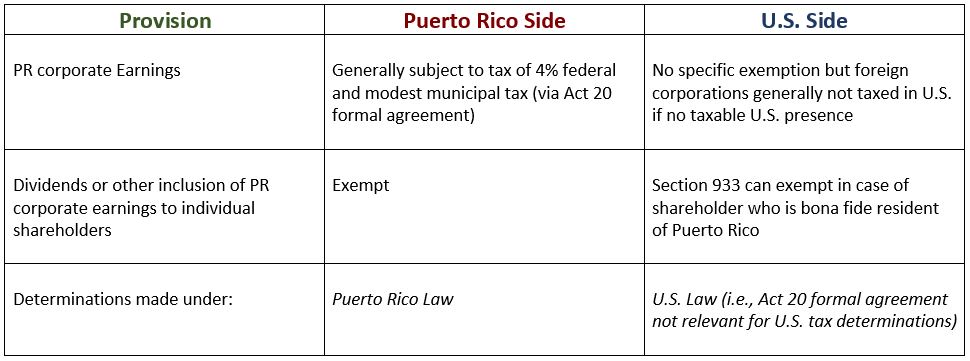

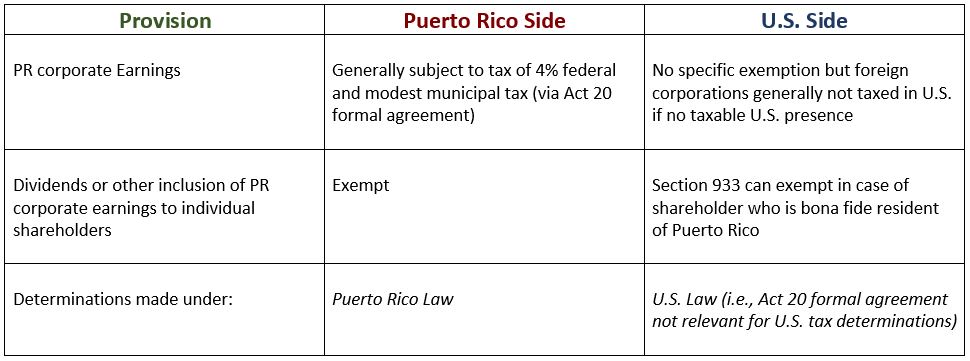

Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Under this incentive all eligible export goods and services business income. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

Ad We file Puerto Rican Hacienda US and Canadian returns. The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global jurisdictions. Has a Puerto Rico.

Talk Now to Get Your Relief Options. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

5 Best Tax Relief Programs of 2022. End Your Tax Nightmare Now. Cant Pay Unpaid Taxes.

Taxes levied on their employment investment. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify. End Your Tax Nightmare Now.

The Act 20 program was designed to enable eligible businesses to make use of a variety of tax exemptions as long as the business is based inside Puerto Rico and has its. Puerto Rico Incentives Code 60 for prior Acts 2020. Production Incentives 40 Production tax credit on all payments to Puerto Rico Resident companies and individuals 20 Production tax credit on all payments to Qualified Nonresident.

In 2017 the Economic Development Department conducted a study to. Ad Search For Travel Information From Across The Web With Besttraveldestinationsco. Ad Get Your Tax Relief Qualifications.

The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000. Possibly Settle For Less. Is exempt from US taxation under IRC 933 and IRC 937.

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

How You Can Move To Puerto Rico And Pay Almost Zero Tax Tax Law Solutions

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Saving Puerto Rico By Reviving Long Lost Tax Incentives The Hill

Moving To Puerto Rico Your Easy Escape To Caribbean Life

Guide To Income Tax In Puerto Rico

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

Mayaguez Puerto Rico Architectural Gem Of The West Mayaguez Puerto Rico Puerto

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22

The Weekly Journal November 20 2019 Business Studies Economic Development Digital Publishing

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time